Environmental, Social and Corporate Governance (ESG)

Overview

We believe that we and our investors are decent, ethical people and that we do business in a thoughtful way. ESG issues are an existential concern for all of us, and we take them seriously at Vanneck, in our work and beyond.

We do not evaluate ESG factors solely for altruistic reasons. Companies which are potentially detrimental to society or have questionable governance are unlikely to be profitable long-term investments.

This is a nuanced area, and we are very wary of adding to the virtue signalling that often emanates from investment firms seeking to exploit the rising demand for ESG investment by pretending there’s an absolute answer.

Our Approach

We consider ESG carefully on a case by case basis guided by the following principles.

Vanneck Approach in Practice

Our ESG approach affects all our investment decisions, but it is nuanced and case by case so isn’t easily captured in blanket statements. We don't believe it is possible to accurately and objectively weigh all the good and ill each company does inside its operations all over the world and then ascribe each a correct ESG ranking.

"ESG" Start-Ups - In Vanneck EIS, we make investments into high risk start-ups that are directly looking to help with ESG (really climate change) issues. For example, in 2017 Vanneck was the first/only investor in Better Origin, a start-up from Cambridge University trying to improve waste efficiency in the poultry sector by feeding chickens black soldier flies instead of grain. 4 years later, the company struck a deal with Morrisons to get the first carbon free eggs into UK supermarkets in 2022. The FT went big on it here.

Negative Screening in listed equities - To give one or two simple examples, we do not own gambling or arms companies. We recognise the counter arguments – tax take, pleasure, free will, right to defend etc. – and don’t think that we are necessarily right or wrong; we’re just not personally comfortable making money out of these industries.

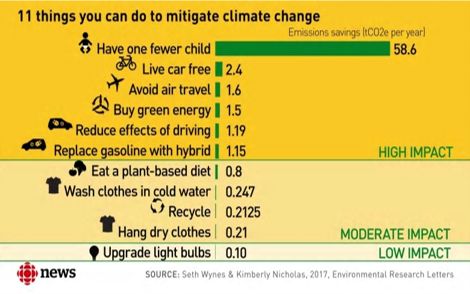

Positive Screening in listed equities - ESG factors inform what we own, not just what we don’t own. E.g. we hold shares in a world leading condom manufacturer; population growth is arguably the largest factor in accelerating climate change (do look at the slide below which we find mesmerising.) We highlight this quirky example deliberately since others might regard it as an unethical investment, depending on the weight they give to competing environmental or religious considerations. Again, ESG is necessarily subjective and personal.

Overview

We believe that we and our investors are decent, ethical people and that we do business in a thoughtful way. ESG issues are an existential concern for all of us, and we take them seriously at Vanneck, in our work and beyond.

We do not evaluate ESG factors solely for altruistic reasons. Companies which are potentially detrimental to society or have questionable governance are unlikely to be profitable long-term investments.

This is a nuanced area, and we are very wary of adding to the virtue signalling that often emanates from investment firms seeking to exploit the rising demand for ESG investment by pretending there’s an absolute answer.

Our Approach

We consider ESG carefully on a case by case basis guided by the following principles.

- We do not want to own companies which are amoral or detrimental to society

- The case for “amorality” has to be broadly unarguable as:

- It is very hard to evaluate exactly what companies are doing.

- Moral judgement is subjective, personal and of its time.

- We are not convinced that it is for companies to impose their views of “doing good” on society.

Vanneck Approach in Practice

Our ESG approach affects all our investment decisions, but it is nuanced and case by case so isn’t easily captured in blanket statements. We don't believe it is possible to accurately and objectively weigh all the good and ill each company does inside its operations all over the world and then ascribe each a correct ESG ranking.

"ESG" Start-Ups - In Vanneck EIS, we make investments into high risk start-ups that are directly looking to help with ESG (really climate change) issues. For example, in 2017 Vanneck was the first/only investor in Better Origin, a start-up from Cambridge University trying to improve waste efficiency in the poultry sector by feeding chickens black soldier flies instead of grain. 4 years later, the company struck a deal with Morrisons to get the first carbon free eggs into UK supermarkets in 2022. The FT went big on it here.

Negative Screening in listed equities - To give one or two simple examples, we do not own gambling or arms companies. We recognise the counter arguments – tax take, pleasure, free will, right to defend etc. – and don’t think that we are necessarily right or wrong; we’re just not personally comfortable making money out of these industries.

Positive Screening in listed equities - ESG factors inform what we own, not just what we don’t own. E.g. we hold shares in a world leading condom manufacturer; population growth is arguably the largest factor in accelerating climate change (do look at the slide below which we find mesmerising.) We highlight this quirky example deliberately since others might regard it as an unethical investment, depending on the weight they give to competing environmental or religious considerations. Again, ESG is necessarily subjective and personal.

Other ESG Contributions

The Vanneck EIS Fund generally is a force for good. We back UK start-ups where others fear to tread, growing successful UK companies that create hundreds of new jobs, innovate, improve productivity and quality of life and pay taxes. We can think of few better ways that an investment business can contribute.

We are proud to support various good causes, both financially and with our time. Most recently, we have supported the following fantastic organisations:

The Vanneck EIS Fund generally is a force for good. We back UK start-ups where others fear to tread, growing successful UK companies that create hundreds of new jobs, innovate, improve productivity and quality of life and pay taxes. We can think of few better ways that an investment business can contribute.

We are proud to support various good causes, both financially and with our time. Most recently, we have supported the following fantastic organisations:

- Music Masters, Brooke Weston Academy Trust, Welbodi Partnership, Cancer We’re Done, National Portrait Gallery, Music As Therapy, Nevill Holt Opera, Rosetrees Trust, John Burns Primary School, The Access Project.